U.S. Unemployment Rate -The U.S. Nonfarm Payrolls and Unemployment Rate will be released Friday, November 2nd, 2018, at 13:30 GMT. It is expected to cause significant volatility in the markets.

An economic indicator that tends to trigger sharp market movements in the minutes leading up to its release and afterwards, the NFP is usually released by the U.S. Department of Labor on the first Friday of each month, outlining changes in the number of employees, excluding farm workers and those employed by the government, non-profit organisations and private households.

What to expect

this month:

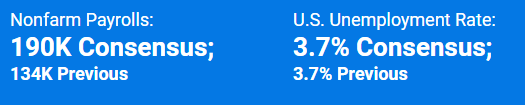

The consensus forecast for October’s Nonfarm Payrolls estimates that the U.S economy generated 191K jobs – a rebound from previous month’s fall to 134K. Despite September’s weak data, the U.S. labour market remains strong, and market participants speculate on whether U.S. could stick with such a pace. The markets will also keep a close eye on the Average Hourly Earning figures, which is forecasted to jump to 3.2% YoY in October (the highest rate since 2009). A release of a higher earnings figures could reinforce expectations for further Fed rate hikes.

A bad NFP figure release below 140K coupled with an Unemployment Rate above 3.7% will likely trigger a downward pressure on the USD. A strong NFP figure release above 240K and an Unemployment Rate below 3.7% will likely cause the USD to rally.

As always, it is important to note that any alteration from the previous month’s figure (134K) will significantly impact the market sentiment.FxPro Analyst Team.

Keep in mind:

During the NFP announcement, expect high volatility, especially across USD pairs.

Market sentiment can really affect currency movements. What traders expect from the report has as much impact as the actual released data, if not greater.

A higher figure than the one registered during the previous month signifies an improvement in employment numbers. This, as well as the release of a higher-than-expected figure, mean an increase in the number of jobs created and are positive for both the U.S. economy and the dollar.

A lower figure than the one registered during the previous month, as well as a lower-than-expected figure, usually have a negative impact on the dollar as they demonstrate a drop in employment numbers.

Remember that the sudden spike observed across the charts of many currency pairs upon the release of the NFPs is usually followed by a period during which the market tries to recover and return to its initial price levels.

Fxpro Forex Cashback

Categories :

Tags : U.S. Unemployment Rate