Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

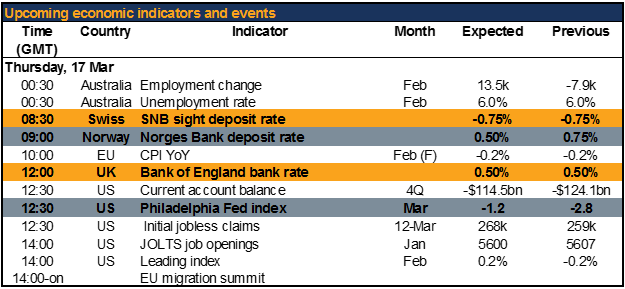

The last day of this stunning two-week series of central bank meetings, the Swiss National Bank (SNB), Norges Bank and Bank of England meet today.

Thursday, 17 March

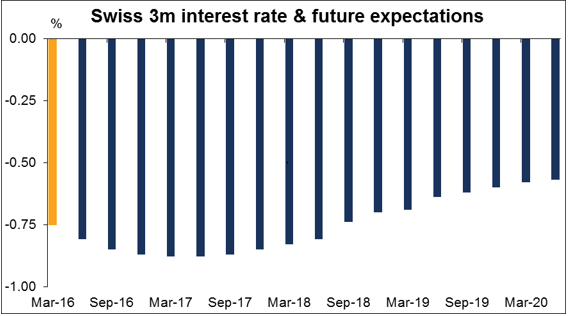

08:30 GMT: SNB rate decision: The market is expecting further rate cuts from the SNB, just not this month. The situation in Switzerland is not great: the country is in deflation, industrial production is falling, retail sales are sluggish, and unemployment has been rising. The trade surplus is rising too, but this is because imports are declining rather than any growth in exports, which go mostly to the EU. Nonetheless, EUR/CHF has stayed within a narrow range of 1.08-1.10 since last September and is currently at the high end of that range, so there is probably no urgency to change policy right now. I expect they will keep rates steady today, just repeating that CHF is “significantly overvalued” (which is certainly is!) and that they will continue to intervene in the FX market as necessary. This would most likely be CHF-neutral or perhaps a bit CHF-positive, in that they are acquiescing to the narrower gap between CHF and EUR rates following the ECB’s move. The big risk for CHF is a “Brexit,” which would probably cause EUR to depreciate dramatically and force SNB to take more dramatic action.

Categories :

Tags : Daily Forex News forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf FxPrimus broker how to trade forex for beginners pdf learning forex trading pdf