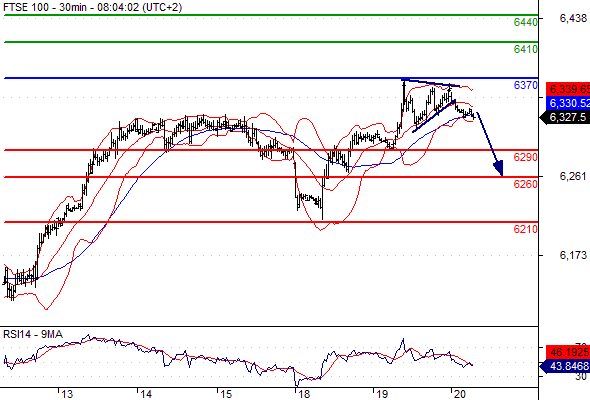

FTSE 100 (NYSE Liffe) (M6) Intraday: consolidation.

Pivot: 6370.00

Our preference: short positions below 6370.00 with targets @ 6290.00 & 6260.00 in extension.

Alternative scenario: above 6370.00 look for further upside with 6410.00 & 6440.00 as targets.

Comment: the RSI lacks upward momentum.

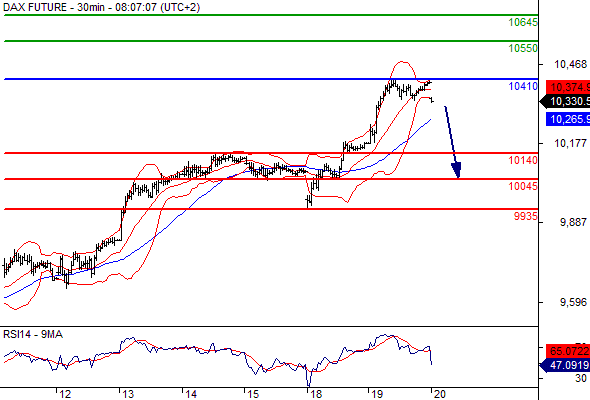

Dax (Eurex) (M6) Intraday: key resistance at 10410.00.

Pivot: 10410.00

Our preference: short positions below 10410.00 with targets @ 10140.00 & 10045.00 in extension.

Alternative scenario: above 10410.00 look for further upside with 10550.00 & 10645.00 as targets.

Comment: the RSI is bearish and calls for further downside.

Dow Jones (CME) (M6) Intraday: the upside prevails.

Pivot: 17875.00

Our preference: long positions above 17875.00 with targets @ 18050.00 & 18090.00 in extension.

Alternative scenario: below 17875.00 look for further downside with 17750.00 & 17690.00 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

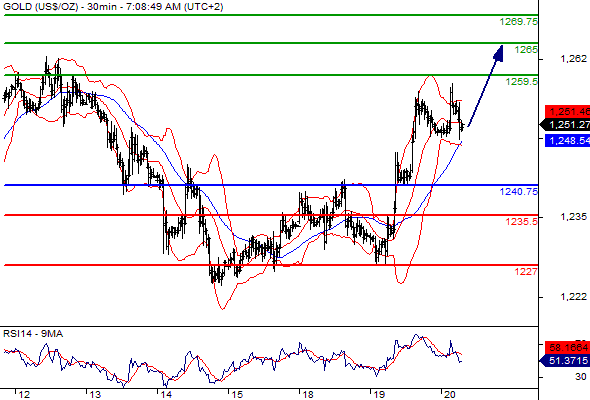

Gold spot Intraday: rebound expected.

Pivot: 1240.75

Our preference: long positions above 1240.75 with targets @ 1259.50 & 1265.00 in extension.

Alternative scenario: below 1240.75 look for further downside with 1235.50 & 1227.00 as targets.

Comment: the RSI is mixed with a bullish bias.

Source: ETX Capittal(Review and Forex Rebates Up to 85%)

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf