The Day Trade Forex System – The ULTIMATE Step-By-Step Guide to Online Currency Trading.

Did you know that more and more business opportunity seekers worldwide are discovering the powerful profit potential of Foreign Exchange trading? In this business, there are no employees to hire, no advertising, no products to stock, no downlines to fill–just you, an Internet connection and a computer. That’s all you need to make money on the worlds largest market. If you are searching for an alternative to more traditional home-based business opportunities, then Forex trading may be what you’ve been looking for.Our purpose is to empower, mentor and train currency traders all around the world who would like to Day Trade Forex as their main source of income. For

those looking for a significant part-time income, we believe Currency Trading is the vehicle to use.

Our aim is to assist you to:

1. Stay Disciplined—To learn how to manage risk effectively.

2. Keep Objective—To trade in a non-emotional, intelligent way.

3. Trade with Confidence—To know exactly when to trade.

4. Become Systematic—To generate your own Forex buy/sell signals.

The goal is to earn $50 to $500 per trade and minimize losses on losing trades using technical indicators on charts, which I will explain later on in this course.The potential to profit is there for those who trade this system. The great thing about Forex trading is that you can test this system for FREE on a demo account using virtual money, before you risk one penny on actual trades.You will be able to join my team of traders as you advance step-by-step through

this guide. We will begin by explaining what Forex is and all the benefits of trading currencies.

WHAT IS FOREX

The Foreign Exchange, also referred to as the “Forex” or “Spot FX” market, is the largest financial market in the world, with over $1.2 trillion changing hands every single day. If you compare that to the $25 billion a day volume that the New York Stock Exchange trades, you see how giant the Foreign Exchange really is. In fact it is three times larger than all of the US Equity and Treasury markets combined!

What is traded on the Foreign Exchange? The answer is money. Forex trading is where the currency of one nation is traded for that of another. Therefore, Forex trading is always traded in pairs. The most commonly traded currency

pairs are traded against the US Dollar (USD). They are called ‘the Majors’. The major currency pairs are the Euro Dollar (EUR/USD); the British Pound (GBP/USD); the Japanese Yen (USD/JPY); and the Swiss Franc (USD/CHF).

The notable ‘commodity’ currency pairs that trade are the Canadian Dollar (USD/CAD) and the Australian Dollar AUD/USD. Because there is not a central exchange for the Forex market, these pairs and their crosses are traded over the telephone and online through a global network of banks, multinational corporations, importers and exporters, brokers and currency traders.

Traditionally, currency trading has been a ‘professionals only’ market available exclusively to banks and large institutions, however, because of the rise of the new E-economy, online Forex trading firms are now able to offer trading accounts to ‘retail’ traders like you and I. Now almost anyone with a computer and an Internet connection can trade currencies just like the world’s largest banks do. There are now over 6 million trading accounts worldwide up from 1.7 million in 1997.

BENEFITS OF FOREX TRADING

There are many benefits and advantages to trading Forex. Here are just a few reasons why so many people are choosing this market as a business opportunity:

1.LEVERAGE: In Forex trading, a small margin deposit can control a much larger total contract value. Leverage gives the trader the ability to make extraordinary profits and at the same time keep risk capital to a minimum. Some

Forex firms offer 200 to 1 leverage, which means that a $50 dollar margin deposit would enable a trader to buy or sell $10,000 worth of currencies.Similarly, with $500 dollars, one could trade with $100,000 dollars and so on.

2.LIQUIDITY: Because the Forex Market is so large, it is also extremely liquid. This means that with a click of a mouse you can instantaneously buy and sell at will. You are never ‘stuck’ in a trade. You can even set the online trading platform to automatically close your position at your desired profit level (limit order), and/or close a trade if a trade is going against you (stop order).

3.PROFIT IN BOTH ‘RISING’ AND ‘FALLING’ MARKETS: On the stock markets, you can only make money if shares are rising, but in economic recession and falling ‘bear’ markets, there is little chance of making big money.Forex is different. One of the most exciting advantages of FX trading is the ability to generate profits whether a currency pair is ‘up’ or ‘down’. A trader can profit by taking a ‘long’ position, (buying the currency pair at one price and selling it

later at a higher price), or a ‘short’ position, (selling the currency pair and buying it back at a lower price). For example, if you think the US dollar will increase in value vs. the Japanese Yen then you will buy Dollars and sell Yen (go long). If you think the Yen will increase in value against the Dollar then you will sell Dollars and buy yen (go short). As long as the trader picks the right direction, a potential for profit always exists.

4. 24HRS: From Sunday evening to Friday Afternoon EST the Forex market never sleeps. This is very desirable for those who want to trade on a part-time basis, because you can choose when you want to trade–morning, noon or night.

5. FREE ‘DEMO’ ACCOUNTS, NEWS, CHARTS AND ANALYSIS: Most Online Forex firms offer free ‘Demo’ accounts to practice trading, along with breaking Forex news and charting services. These are very valuable resources for traders who would like to hone their trading skills with ‘virtual’ money before opening a live trading account.

6.’MINI’ TRADING: One might think that getting started as a currency trader would cost a lot of money. The fact is, it doesn’t. Online Forex Firms now offer ‘mini’ trading accounts with a minimum account deposit of only $200-$500 with no commission trading. This makes Forex much more accessible to the average individual, without large, start-up capital.

The Day Trade Forex System

Foundations:Before we begin looking at the specifics of the FPS and how it works, let’s look at 4 building blocks that I believe to be foundations to the Forex Profit System.

Currency trading is a SKILL that takes TIME to learn. Skilled Traders can and do make money in this field, however like any other occupation or career, success doesn’t just happen overnight. Here is a great ‘formula’ for success:

Practice + Patience + Persistence = Profits

As they say, there is no substitute for hard work and diligence. Practice trading on a demo account and pretend the virtual money is your own real money. Do not open a live trading account until you are profitable trading on a demo account. Stick to the plan and you can be successful.

Foundation #2: I highly recommend that you follow 1 or maybe 2 major currency pairs.

It gets far too complicated to keep tabs on all four. I also recommend that traders choose one of the majors because the spread is the best and they are the most liquid. The Euro/USD is the most commonly traded pair and usually has the best ‘spread’ because of its liquidity. The USD/Swiss Franc is usually the most volatile and moves the most during the trading week. The USD/Yen moves a lot on the news out of Japan and normally the Pound Sterling/USD is more stable in it’s moves than the other three.

Foundation #3: Follow and understand the daily Forex News and Analysis of the professional currency analysts.

Even though this system is based solely on technical analysis of charts, it is important to get a birds-eye view of the currency markets and the news that affects the prices. It is also important that you know and understand what the

key technical ‘support’ and ‘resistance’ levels are in the currency pair that you want to trade. Support is a predicted level to buy (where currency pair should move up on the charts), resistance is a predicted level to sell (where the

currency pair should move down on the charts).

Fortunately, all the best Forex news and analysis is offered free on the Internet. Here is what you should do first:

*While you are reading the daily news and technical analysis, write down on a piece of paper what direction the analysts are saying about the major currency pair you are following and the key support and resistance levels for the day.

A. Go to www.forexnews.com and you will find 24hr news and analysis on the spot FX markets. The site will give you the big picture of how the economic calendar and central banks affect the currency markets. A great resource.

B. Then go to www.fxstreet.com and click on the ‘Top Forex Reports’. Here there is a wonderful listing of all the major daily currency analysis and forecasts with support and resistance and direction forecasts.

C. Click on www.currencypro.com and go to ‘Today’s Market Research’ and there you will find more excellent analysis on the Major Currency pairs. Another great Forex Portal.

Foundation #4: Learn how to use the technical indicators in this course and always trade with stop losses!

It is worth your time to be patient and learn how to use the technical indicators on the charts that you will be reading about shortly.

It is important when you are trading Forex, to be disciplined and to stick to a plan. Don’t just trade your ‘gut’ feeling. Use the technical indicators outlined and always enter in stop losses on every trade. Remember that everyone who trades has a different tolerance for losses. Depending on your risk capital, and strategy, set your stop losses accordingly.

The Day Trade Forex System:

Six Steps to Success

The goal of this guide is to instruct and teach potential traders how to day trade the currency markets. The objective of day trading is to trade the intra day market moves to try to gain small to medium sized profits in any given trading

day. This is how this guide will help. Most readers will not have the time or resources to ‘position trade’ like the major institutions and banks do. They tend to look at the big picture holding onto trades for weeks or months.

The Forex Profit System is specifically designed for use with the 1, 5 or 10 minute charts, with the goal of taking 5-20 pip profits per trade—closing bad trades out using tight stops, or hedging any losing trades. The following steps will show you how to do this.

Step 1. Choose an online Forex Firm

What to look for in an online Forex Firm:

1. Low Spreads.

In Forex Trading the ‘spread’ is the difference between the buy and sell price of any given currency pair. The lower the spread saves the trader money. Most firms offer 4-5 pip spreads in the Major Currency pairs. The best firms offer clients 3-5 pips.

2. Low minimum account openings.

For those that are new to trading, and for those that don’t have thousands of dollars in risk capital to trade, being able to open a mini trading account with only $200 is a great feature for new traders.

3. Instant automatic execution of your orders.

This is very important when choosing a Forex firm. You want instant execution of your orders and the price you see and ‘click’ is the price that you should get. Don’t settle with a firm that re-quotes you when you click on a price or a firm that allows for price ‘slippage’. This is very important when trading for small profits.

4. Free charting and technical analysis

You need a firm that gives you access to the best charting and technical analysis available to active traders. The firm that I recommend gives clients FREE professional charting services and even allows traders to trade directly on the charts!

5. High Leverage

You want high leverage—the ability to trade a large amount with a small margin deposit. Some of the best firms offer .25% or 400:1 leverage.

6. Hedging Capability

You want the flexibility of opening positions on the same currency pair in opposite directions without them eliminating each other and without margin increase!

Step 2. Open a ‘Visual Trading’ Demo Account

The first step to trading the currency markets is to open a demo account. It is important that you learn how to buy and sell the currency pairs, set stop losses, set profit limits, and understand how leveraged margin works when you trade. I found the best way to learn this is by experience.

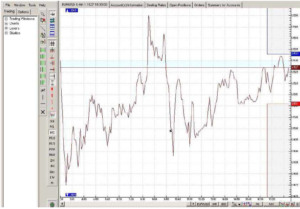

Step 3: Set up your charts:

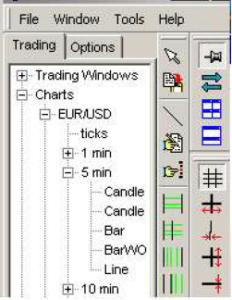

A. One the left hand side of screen you will be able to choose your chart. Choose EUR/USD (or whatever currency pair you like) , 5 min, line and the chart will appear on the right hand side. Maximize the chart to fill the right hand side.

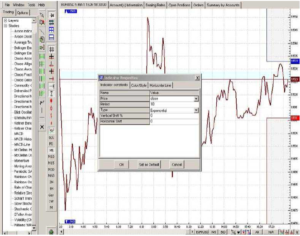

Your chart should now look something like this:

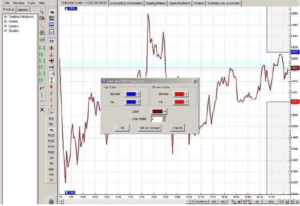

Now if you want to make the price line darker, you can right click right on the price line and a properties box will appear. You can adjust the thickness of the line. In this example the price line width is set it to 2.

C. Now we will add the Moving Averages to the chart. We will be using the Exponential Moving Average 10, the Bollinger Band Exponential Set at 20, and the Exponential Moving Average 50.

Click on Moving Average on the left hand side under Studies. Set your first MA to 10, close, exponential and you can make it red with line width 2 under the Color/Style Tab. Click on Moving Average again and add your MA 50, close,

exponential and make this line blue with line width 2. Here is a shot of the Moving Average Properties window:

D. Now go to the studies on the left hand side of your screen Select Bollinger Bands and set them to 20,2, close exponential. Make the middle band green, line width 2.

E. Add Parabolic SAR to your chart by selecting it on the left and use the default settings. Make the dots darker, by selecting line width 2.

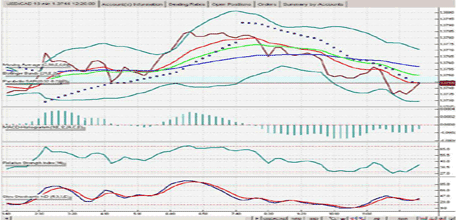

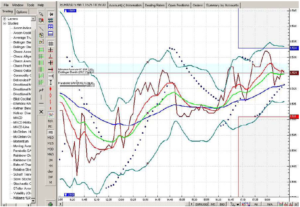

Your chart should now look like this:

You can zoom in and out of your chart using the small buttons in the bottom right hand side of your screen.

How To Change the Currency Pair and Time Frame:

On the bottom of your chart, you can change the currency pair and right beside it, if you click on the button that says M5 you can change the time frame of the chart. The studies will automatically be added to any new time frame and

currency pair that you select.

How to Exit the VT Platform Properly:

To exit the VT platform, click on FILE and then EXIT. The studies that you added to your chart will automatically be up the next time that you log in to your account. Please note that if you click x on the top left hand corner of your chart you will close the chart and reset your settings that you added. If you want to keep your studies and charts intact you can minimize it or just leave always keep it open to keep your settings saved.

F. Now we will add 3 more indicators below the chart to help us confirm the trend, and to help us identify exact entry and exit buy or sell signals. The following indicators give us insight into the momentum, direction and overbought/sold indicators. Used along with the Exponential Moving Averages, Parabolic SAR and Bollinger Bands—these indicators can be very helpful to the day trader.

Under Studies click on MACD Histogram and use the default settings (9,Exponential, 12, 26, Close, Exponential) and set the line width to 2. Your study will automatically open under your chart.

Under Studies click on Relative Strength Index and set it to 14 and set the line width to 2. Your study will automatically open under your chart.

Under Studies click on Slow Stochastic and set it to (5,3,3, Exponential) and make the %K line blue with line width 2, and the %D line red with line.

Your chart, with all the studies on it should now look like this (example of USD/CAD 10 min chart): Notice that I clicked on the zoom in button a couple of times on the bottom right hand corner to get it to look like this.

To read More,Please download the book.

By: Erol Bortucene and Cynthia Macy

ads securities no deposit bonus, binary options demo account, binary options learn, binary options strategy pdf, binary options trader, binary trading strategies pdf, Bollinger bands, currency pair, Download The Day Trade Forex System, forex no deposit bonus, forex no deposit bonus 2016, forex trading learn, FX markets, hot forex no deposit bonus, learn binary, learn forex market, learn forex market trading, learning forex trading online, MACD Histogram, no deposit bonus forex, no deposit bonus forex august 2016, Parabolic SAR, The Day Trade Forex System, The Day Trade Forex System ebook, VT Platform

Similar Videos and E-books

LEAVE A COMMENT

All Books

For Beginners

- Candlesticks For Support And Resistance

- Online Trading Courses

- Commodity Futures Trading for Beginners

- Hidden Divergence

- Peaks and Troughs

- Reverse Divergences And Momentum

- Strategy:10

- The NYSE Tick Index And Candlesticks

- Trend Determination

- The Original Turtle Trading Rules

- Introduction to Forex

- The Six Forces of Forex

- Study Book for Successful Foreign Exchange Dealing

- Forex. On-Line Manual for Successful Trading

- 18 Trading Champions Share Their Keys to Top Trading Profits

- The Way to Trade Forex

- The Truth About Fibonacci Trading

- Quick Guide to Forex Trading

- Chart Patterns and Technical Indicators

- Forex Trading

- Trading Forex: What Investors Need to Know

- My Dog Ate My Forex

- Point & Figure for Forex

Forex Market in General

- Screen Information, Trader Activity, and Bid-Ask Spreads in a Limit Order Market

- Strategic experimentation in a dealership market

- Limit Orders, Depth, and Volatility

- Reminiscences of a Stock Operator

- Market Profile Basics

- Quote Setting and Price Formation in an Order Driven Market

- Phantom of the Pits

- An Introduction to Market Profile and a Users Guide to Capital Flow Software

- The Effect of Tick Size on Volatility, Trader Behavior, and Market Quality

- Trading as a Business

- What Moves the Currency Market?

- Macroeconomic Implications of the Beliefs and Behavior of Foreign Exchange Traders

- All About the Foreign Exchange Market in the United States

Psychology of Trading

- A Course in Miracles

- Thoughts on Trading

- Calming The Mind So That Body Can Perform

- Lifestyles of the Rich and Pipped

- The Miracle of Discipline

- Zoom in on Personal Trading Behavior And Profit from It

- The Woodchuck and the Possum

- 25 Rules Of Forex Trading Discipline

- Stop Losses Are For Sissies

- Your Personality and Successful Trading

- Trading as a Business

- The 7 Deadly Sins of Forex (and How to Avoid Them)

- The 5 Steps to Becoming a Trader

Money Management

- Risk Control and Money Management

- Money Management

- Position-sizing Effects on Trader Performance: An experimental analysis

- Fine-Tuning Your Money Management System

- Money Management: Controlling Risk and Capturing Profits

- Money Management Strategies for Serious Traders

- The Truth About Money Management

- Money Management and Risk Management

Forex Strategy

- 1-2-3 System

- Bollinger Bandit Trading Strategy

- Value Area

- The Dynamic Breakout II Strategy

- Ghost Trader Trading Strategy

- King Keltner Trading Strategy

- Scalp Trading Methods

- LSS - An Introduction to the 3-Day Cycle Method

- Market Turns And Continuation Moves With The Tick Index

- The Money Manager Trading Strategy

- Picking Tops And Bottoms With The Tick Index

- The Super Combo Day Trading Strategy

- The Eleven Elliott Wave Patterns

- The Thermostat Trading Strategy

- Intraday trading with the TICK

- Traders Trick Entry

- Fibonacci Trader Journal

- Rapid Forex

- Microtrading the 1 Minute Chart

- BunnyGirl Forex Trading Strategy Rules and FAQ

- The Daily Fozzy Method

- Forex Traders Cheat Sheet

- Offset Trading

- How to Trade Both Trend and Range Markets by Single Strategy?

- A Practical Guide to Technical Indicators; Moving Averages

- FX Wizard

- FX Destroyer

- A Practical Guide to Swing Trading

- Practical Fibonacci Methods for Forex Trading

- Using The Heikin-Ashi Technique

- The Day Trade Forex System

- 5/13/62

- Not So Squeezy Trading Manual

- KobasFX Strategy

- Killer Patterns

- 3D Trading

- 4 Hour MACD Forex Strategy

- WRB Analysis Tutorial

Advanced Forex Trading

- A New Interpretation of Information Rate

- CCI Manual

- Nicktrader and Jeff Explaining Reverse and Regular Divers

- NickTrader on No Price CCI Divergence Trading

- Are Supply and Demand Driving Stock Prices?

- The Sharpe Ratio

- The Interaction Between the Frequency of Market Quotes, Spread and Volatility in Forex

- Trend Determination

- Trend vs. No Trend

- A Six-Part Study Guide to Market Profile

- How George Soros Knows What He Knows

- Core Point and Figure Chart Patterns

- Coders Guru Full Course

- Point and Figure Charting: a Computational Methodology and Trading Rule Performance in the S&P 500 Futures Market

- Evolving Chart Pattern Sensitive Neural Network Based Forex Trading Agents

- Heisenberg Uncertainty Principle and Economic Analogues of Basic Physical Quantities

- The String Prediction Models as an Invariants of Time Series in Forex Market

- Using Recurrent Neural Networks to Forecasting of Forex

- The New Elliott Wave Rule - Achieve Definitive Wave Counts