British pound gives back gains on Carney’s comments – The British pound fell yesterday evening sharply after comments of rate cuts and QE from BoE’s Carney. The euro also came under pressure giving back some of the gains made from earlier this week. The markets remain in a consolidation phase following the strong moves from the week before. With a new trading month, economic data will be back in focus as the markets could be looking to a breakout from the ranges over the coming days.

EURUSD Daily Analysis

EURUSD (1.109): EURUSD formed an outside bar on the daily session yesterday after QE and rate cut comments from the BoE Governor, Carney. The price action from the past three days shows a kind of consolidation taking place near the minor resistance level at 1.110 and a bearish turn around here could push the euro back to trading within 1.110 and 1.10 previous support. The minor rising trend line connecting the lows of 1.09473 from 24/06 and 1.10729 lows from 30/06 could signal a near term decline in prices on a breakout below the trend line. In the near term, EURUSD could remain trading sideways and further upside can be seen only on a breakout above 1.1128 for 1.120 and a breakout from the trend line could see prices falling back to 1.10.

USDJPY Daily Analysis

USDJPY (102.9): USDJPY has been inching higher gradually, but the pace of the gains has been relatively small. That said, the dollar remains supported above 102Yen. There was an attempt to breakout above 103 resistance from the ascending triangle pattern, but prices quickly fell back lower indicating another session of consolidation below 103. The bias remains to the upside unless the trend line is broken which could weaken the dollar back to 102 lower support.

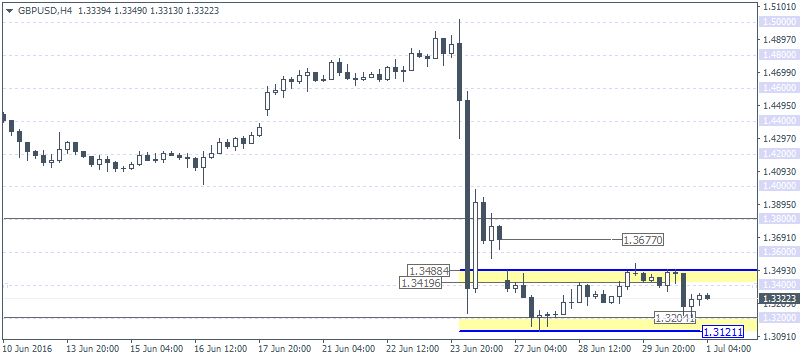

GBPUSD Daily Analysis

GBPUSD (1.332): GBPUSD remains trading flat after giving up the past two days of gains yesterday evening. Prices briefly fell back to lows just above 1.32 support. The support/resistance level identified on the chart earlier this week remains a strong range for GBPUSD, and further price action is likely only on a break out from this range. Watch for 1.3488 – 1.3419 resistance and 1.3204 – 1.3121 support.

Gold Daily Analysis

XAUUSD (1330.09): Gold prices continue to modestly push higher following the pullback from Tuesday earlier this week. While 1350 – 1300 remain the levels of interest, the current consolidation is seen within 1327.5 – 1310.5 are showing a possible breakout to the upside. A confirmed breakout from this range could see gold prices edge higher and potentially test the 1350 levels in the near term.

Source: Orbex Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : British pound EUR/USD forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf Orbex Forex Broker XAUUSD