Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

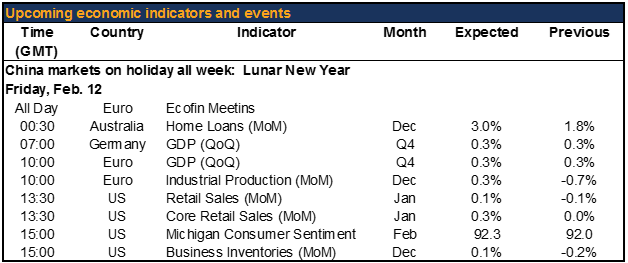

07:00 GMT Germany -GDP (Q4):The country already released its flash estimate for GDP in 2015, without breaking out Q4’s performance. Based on that estimate and hints from the Federal Statistical Office, there shouldn’t be any major surprise here.

10:00 GMT EU – GDP (Q4):The market expects that growth in the Eurozone as a whole remained steady in Q4. A decent number probably won’t change any views on ECB policy or the EUR, though.

13:300 GMT US – Retail sales (Jan):There were some quite serious snowstorms in January to distort the figures. Nonetheless, the market expects some recovery in core retail sales, which would probably be USD-positive.

15:00 GMT US – U of Michigan consumer sentiment (Feb): With employment continuing to improve, wages rising, and gasoline prices falling, consumer sentiment is expected to rise further. USD-positive.

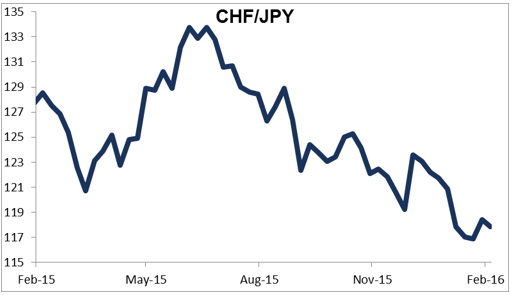

CHF/JPY trending lower as Japanese investors hedge their overseas assets

After peaking in June, CHF/JPY has been steadily declining (i.e., JPY has been appreciating faster than CHF).

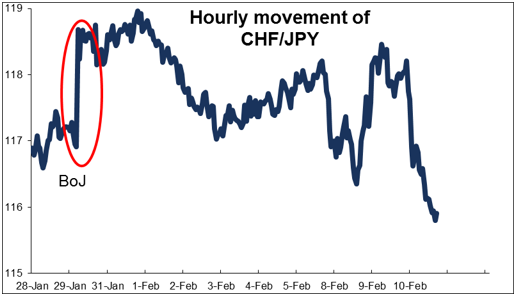

The pair temporarily moved up when the Bank of Japan moved into negative interest rates, but that move has faded entirely.

USD/CHF has been trending upwards, while USD/JPY has been trending down. This is despite the fact that the two currencies are lumped together as the “safe haven” currencies, i.e. the ones that tend to appreciate when the world gets more risky.

Categories :

Tags : CHF/JPY forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf USD/JPY usdchf