Forex Currency Strength Strategy

What is currency strength?

Currency pairs (symbols) are made up of two individual currencies. Currency strength in Forex market means analysis the currencies value during specify time for example when GBPUSD and EURUSD go up and USDCHF and USDJPY fall down during last 4 hours it means that US dollar value decreasing this knowledge give us good view too analyze market for instance according to above example when we analyze AUDUSD and we saw sell signal on it we should think more about our analyze accuracy because US dollar value decreasing now well AUDUSD should go up here we can think about 2 scenarios:

- Us dollar value will effect on AUD later

- AUD value is decreasing more than US dollar.

To understand this, we can look at the other currencies value vs Australian Dollar value like GBPAUD EURAUD AUDJPY etc. If we found that AUD value is decreasing vs the other currencies, it will show us our signal is correct but if it shows us AUD value vs other currencies is not decreasing it can show us our signal can’t be correct.

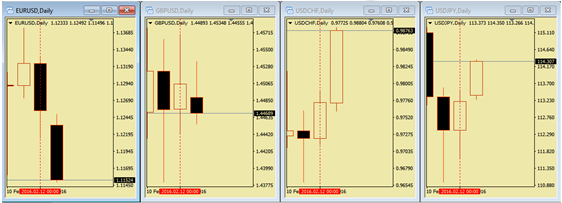

For example, please look at pictures:

On 2016.02.12 US value versus EUR and CHF and USD increased but versus GBP decreased

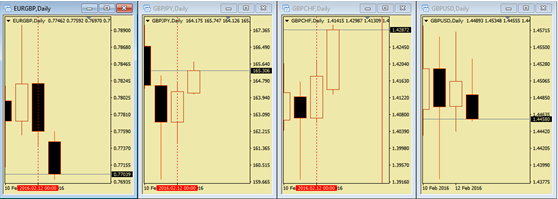

Well now we should check GBP value VS other currencies:

This show us GBP value versus EUR, JPY, CHF, and US dollar increased.

Now we understand GBP value is increasing more than US value well let’s look more carefully.

You can see EUR value versus USD and GBP decreased more than other currencies is it show us that EUR is a weakest currency and GBP is strongest?

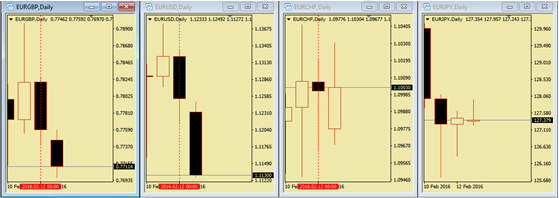

Again we need compare EUR versus others:

EUR just against GBP and USD and CHF decreased but against JPY increased now we should think JPY is weakest currency or not?!

Again:

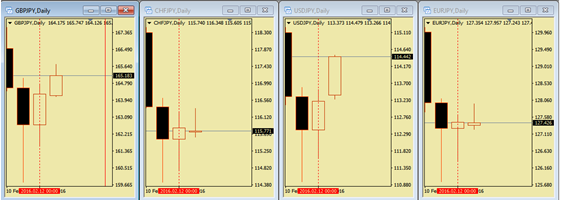

Now we understand that GBP is strongest and JPY is weakest currency in our challenge between USD, JPY, GBP and CHF

please look at GPB.JPY symbol in the next trading day I means 2016.02.15

You can see GBP.JPY goes up in the next day GBP was strongest and USD was strongest against the other three currencies now let see what happened for 2 strong currencies on 15 Feb 2016:

As you can see on GBPUSD we had uptrend till 8 O’clock but after 8 O’clock market fall down it show us USD win against GBP today.

If you search on the internet you can found a lot of indicators and expert advisors for trade on market according to the currency strength If you don’t like use them, you can just look at the time frames and understand this.

To avoid mistake always check important news especially the EUR USD and GBP forex news because the news can change everything most time after an

important economic event the weakest currency will change the trend and become strongest during a few minutes.

The other important note is you can compare currencies pair and understand the market movement behavior after the news you can understand it for instance sometimes you don’t know what is the retail sales effect on the market now When news announced you can compare all pairs and understand the news effect.

Why should I use currency strength indicators in my forex trading?

Five important reasons:

- When most technical indicators and factor can’t give us good analysis view forex currency strength analysis can give us good forex signal.

- You will never know when not to trade or when conditions are favorable to trade but by comparing forex symbols you can understand this.

- You will always know the condition of the overall market.

- Using currency strength and weakness forex strategy keeps the emotions out of your trade decisions and emotions give way to using market logic to govern your trades.

- Forex currency strength trading is straightforward and any forex trader can learn it very easy even if you are beginner you can understand market condition by compare chart by just a simple look.

Author: M.Jamshidi

binary options learn, binary options strategy pdf, binary options trader, binary trading strategies pdf, forex bonus without deposit, Forex Broker, forex broker bonus, Forex Education, Forex Education Books, forex learn, forex learning, forex learning pdf, forex trading learn, forex tutorials for beginners pdf, how to trade forex for beginners pdf, learn binary, learn forex market, learn forex market trading, learning forex trading online, learning forex trading pdf, trading binary options strategies and tactics pdf free

Similar Videos and E-books

LEAVE A COMMENT

All Books

For Beginners

- Candlesticks For Support And Resistance

- Online Trading Courses

- Commodity Futures Trading for Beginners

- Hidden Divergence

- Peaks and Troughs

- Reverse Divergences And Momentum

- Strategy:10

- The NYSE Tick Index And Candlesticks

- Trend Determination

- The Original Turtle Trading Rules

- Introduction to Forex

- The Six Forces of Forex

- Study Book for Successful Foreign Exchange Dealing

- Forex. On-Line Manual for Successful Trading

- 18 Trading Champions Share Their Keys to Top Trading Profits

- The Way to Trade Forex

- The Truth About Fibonacci Trading

- Quick Guide to Forex Trading

- Chart Patterns and Technical Indicators

- Forex Trading

- Trading Forex: What Investors Need to Know

- My Dog Ate My Forex

- Point & Figure for Forex

Forex Market in General

- Screen Information, Trader Activity, and Bid-Ask Spreads in a Limit Order Market

- Strategic experimentation in a dealership market

- Limit Orders, Depth, and Volatility

- Reminiscences of a Stock Operator

- Market Profile Basics

- Quote Setting and Price Formation in an Order Driven Market

- Phantom of the Pits

- An Introduction to Market Profile and a Users Guide to Capital Flow Software

- The Effect of Tick Size on Volatility, Trader Behavior, and Market Quality

- Trading as a Business

- What Moves the Currency Market?

- Macroeconomic Implications of the Beliefs and Behavior of Foreign Exchange Traders

- All About the Foreign Exchange Market in the United States

Psychology of Trading

- A Course in Miracles

- Thoughts on Trading

- Calming The Mind So That Body Can Perform

- Lifestyles of the Rich and Pipped

- The Miracle of Discipline

- Zoom in on Personal Trading Behavior And Profit from It

- The Woodchuck and the Possum

- 25 Rules Of Forex Trading Discipline

- Stop Losses Are For Sissies

- Your Personality and Successful Trading

- Trading as a Business

- The 7 Deadly Sins of Forex (and How to Avoid Them)

- The 5 Steps to Becoming a Trader

Money Management

- Risk Control and Money Management

- Money Management

- Position-sizing Effects on Trader Performance: An experimental analysis

- Fine-Tuning Your Money Management System

- Money Management: Controlling Risk and Capturing Profits

- Money Management Strategies for Serious Traders

- The Truth About Money Management

- Money Management and Risk Management

Forex Strategy

- 1-2-3 System

- Bollinger Bandit Trading Strategy

- Value Area

- The Dynamic Breakout II Strategy

- Ghost Trader Trading Strategy

- King Keltner Trading Strategy

- Scalp Trading Methods

- LSS - An Introduction to the 3-Day Cycle Method

- Market Turns And Continuation Moves With The Tick Index

- The Money Manager Trading Strategy

- Picking Tops And Bottoms With The Tick Index

- The Super Combo Day Trading Strategy

- The Eleven Elliott Wave Patterns

- The Thermostat Trading Strategy

- Intraday trading with the TICK

- Traders Trick Entry

- Fibonacci Trader Journal

- Rapid Forex

- Microtrading the 1 Minute Chart

- BunnyGirl Forex Trading Strategy Rules and FAQ

- The Daily Fozzy Method

- Forex Traders Cheat Sheet

- Offset Trading

- How to Trade Both Trend and Range Markets by Single Strategy?

- A Practical Guide to Technical Indicators; Moving Averages

- FX Wizard

- FX Destroyer

- A Practical Guide to Swing Trading

- Practical Fibonacci Methods for Forex Trading

- Using The Heikin-Ashi Technique

- The Day Trade Forex System

- 5/13/62

- Not So Squeezy Trading Manual

- KobasFX Strategy

- Killer Patterns

- 3D Trading

- 4 Hour MACD Forex Strategy

- WRB Analysis Tutorial

Advanced Forex Trading

- A New Interpretation of Information Rate

- CCI Manual

- Nicktrader and Jeff Explaining Reverse and Regular Divers

- NickTrader on No Price CCI Divergence Trading

- Are Supply and Demand Driving Stock Prices?

- The Sharpe Ratio

- The Interaction Between the Frequency of Market Quotes, Spread and Volatility in Forex

- Trend Determination

- Trend vs. No Trend

- A Six-Part Study Guide to Market Profile

- How George Soros Knows What He Knows

- Core Point and Figure Chart Patterns

- Coders Guru Full Course

- Point and Figure Charting: a Computational Methodology and Trading Rule Performance in the S&P 500 Futures Market

- Evolving Chart Pattern Sensitive Neural Network Based Forex Trading Agents

- Heisenberg Uncertainty Principle and Economic Analogues of Basic Physical Quantities

- The String Prediction Models as an Invariants of Time Series in Forex Market

- Using Recurrent Neural Networks to Forecasting of Forex

- The New Elliott Wave Rule - Achieve Definitive Wave Counts