Forex Daily Analysis – EURUSD remained to trade in a range with prices seen re-testing 1.120 handle earlier today. Today’s US consumer inflation report and US building permits and housing starts will be the key events that could shape the near-term bias. Gold prices were also seen rallying back to the 1347 – 1350 resistance level with further momentum likely to come in after the US economic releases. For the British pound, today’s inflation report will show how consumer prices fared, for the whole month following the Brexit vote.

EURUSD Daily Analysis

EURUSD (1.120): EURUSD was seen retesting the 1.120 handle yesterday with today’s price action seen bullish near the resistance level. 1.124 – 1.120 will be of importance heading into today’s US economic releases. A weak print on consumer inflation could see the FOMC minutes likely to be ignored as markets scale back bets for a September rate hike. On the other hand stronger than expected inflation report could see the euro pare gains with 1.120 being established as resistance. 1.1150 remains the short-term support level that could halt the declines in the near term.

USDJPY Daily Analysis

USDJPY (100.48): USDJPY is seen extending the declines with prices likely to test 100.00 support after closing in a small range yesterday. The declines to the psychological level of 100.00 could be tested, but a pullback to 101.00 cannot be ruled out. On the 4-hour chart, the Stochastics remains lower bound near the oversold levels, and unless there is some evidence of prices pulling back, USDJPY could remain weaker.

GBPUSD Daily Analysis

GBPUSD (1.2908): GBPUSD is posting a a minor bounce near 1.290, but the CPI report is likely to add further momentum, which could either see GBPUSD continue to slide towards 1.280 or post a correction towards 1.30. On the 4-hour chart, price action remains weak with the Stochastics staying in the oversold levels. However, the doji pattern near the bottom end of the decline could see some near-term correction take place. 1.295 will be the first resistance level of interest, and a break higher could see GBPUSD test 1.30.

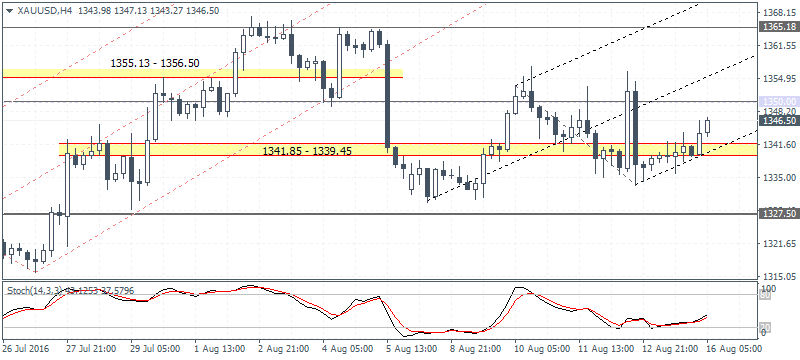

Gold Daily Analysis

XAUUSD (1346.50): Gold prices are moving in a range from Friday’s session with price action today seen retesting the 1347 – 1350 handle. Further upside could be seen only on a daily bullish close above 1347 – 1350, in which case gold prices could be seen establishing new highs. To the downside, 1340 – 1341 support has managed to hold the prices resulting in a reversal. A break down below this support level is essential for gold prices to slide towards 1327.50. Expect gold prices to remain range bound with the FOMC meeting minutes likely to add to the bias.

Categories :

Tags : FOMC meeting forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf forex tutorials for beginners pdf GBPUSD Daily Analysis Gold Daily Analysis how to trade forex for beginners pdf learning forex trading pdf Orbex Forex Broker USDJPY Daily Analysis