Forex Daily News(2016.01.29)

Source: Fxprimus Forex Broker (Review and Forex Rebates up to 85%)

US durable goods orders and pending home sales were disappointing yesterday. Disappointing indicators are getting to be the norm for the US. In fact, they’re now the norm for the US, Eurozone, Japan, UK and China. That’s worrisome for global growth. Weak US indicators don’t necessarily mean a weak dollar, but they do suggest that further declines in EUR/USD depend more on further weakness in Europe rather than signs of strength in the US.

More disappointing US data. Durable goods orders for December were far, far below expectations at -5.1% mom vs expected -0.7%, while the closely watched nondefense capital goods orders excluding aircraft – the best forward-looking indicator of business investment – collapsed 4.3% mom instead of being down only 0.2% mom as expected. Of course durable goods orders have been weak for some time so this was perhaps not so surprising a surprise, if that makes sense. US pending home sales also failed to beat expectations once again. There was record demand for the seven-year Treasury note at the auction and the implied rate on Fed fund futures slipped a couple of basis points, suggesting that the idea of Fed tightening is fading further.

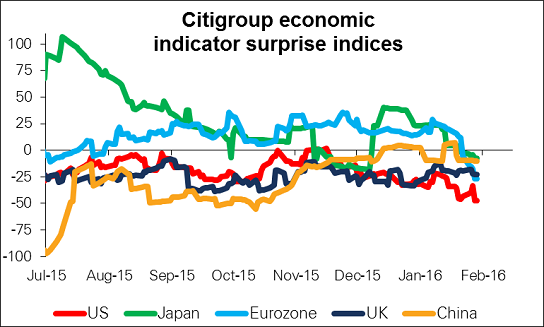

Negative surprises on US indicators are getting to be the norm nowadays.In fact since last January, the Citi US economic surprise indicator has been above zero for only five days, which is pretty remarkable considering that in theory it should be mean-reverting: if economists find they are too optimistic, they should revise down their forecasts until they become too pessimistic. Perhaps this is just a manifestation of the refusal of economists to foresee bad news. An IMF study from 2000 concluded that “the record of failure to predict recessions is virtually unblemished,” and things haven’t gotten any better since then.

Looking at the graph of the surprise indices, three key points stand out. One is that the massively negative forecasting errors that took place in China in July have now been corrected, and estimates are coming in around the actual level. Does that signify that the market’s view on China is becoming more realistic, or that the authorities there are massaging the data better? Either way, it may mean less concern about the kind of “global economic and financial developments” that the Fed is “closely monitoring,” and therefore could make it easier for them to keep hiking rates – or at least allow other central banks to hold off cutting rates again.

Secondly, note that the surprise indices for the five major economic zones are now negative. That certainly can’t be good. It may mean that even if central banks don’t cut rates further, they aren’t likely to start raising them any time soon, and the threat of loose monetary policies will hang over the global financial system for some time. That’s a recipe for “currency wars.”

Categories :

Tags : EUR/USD forex bonus without deposit Forex Broker forex broker bonus Forex Daily News forex learn forex learning forex learning pdf forex tutorials for beginners pdf FxPrimus how to trade forex for beginners pdf learning forex trading pdf