Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

Forex News – The Bank of Japan’s adoption of negative rates in January changed what was perceived as an extraordinary measure into a respectable tool in the central banker’s toolbox. However, last Thursday’s ECB policy changes showed the limits to negative rates (because of the problems they create for the banking system) and the need to focus policy on boosting credit growth, not depressing the exchange rate. That makes it even less likely that any of the central banks announcing this week will lower rates further.

I’ve discussed the BoJ, Fed and BoE at some length in a webinar and an article for the NASDQ website, so I will just say the conclusion here: I expect the BoJ to stand pat, which may disappoint those who were looking for further easing moves and could therefore cause the yen to strength. The Fed too may surprise the market by forecasting greater tightening this year than investors expect, which could strengthen the dollar. The BoE is not likely to make any notable changes and their meeting should have relatively less impact than the other meetings.

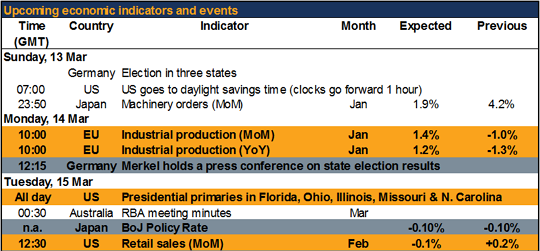

Politics are likely to play a role in trading this week. Today the markets will deal with the results of Sunday’s regional elections in Germany. Mrs. Merkel will hold a press conference about them this afternoon. Then on Tuesday, there are several major US presidential primaries. If Ohio Gov. Kasich wins his home state and Florida Senator Rubio wins his, frontrunner Donald Trump might not be able to wrap up the nomination and it could go to a brokered convention. On the other hand, their loss Tuesday could seal Trump’s victory. Separately, there’s also an EU migration summit on Thursday andFriday.

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex News forex tutorials for beginners pdf FxPrimus broker how to trade forex for beginners pdf learning forex trading pdf