Market Review for January 20, 2016

Source: Vinson Financials Broker (Review and Forex Rebates Up to 85%)

The oil is dropping and the selling pressure is increasing is what describes the market today. The new sell off caused in global markets made USDJPY to trade near below the 116 level. Recent hopes of further stimulus in China have fade out and as crude is resuming its downward trek, investors prefer the safe haven assets like JPY, CHF or German Bunds and U.S. Treasuries. EURUSD risen to 1.0975 levels but the same time EURJPY declined to 127.06.

The commodity currencies are again under pressure and CAD is suffering the most and the with fresh high of USDCAD 1.4690 makes it clear. This further selloff is just ahead of BoC rate decision where it’s expected that the central bank may keep interest rate unchanged at 0.50%, and signal the possibility of a cut in the next meeting, nonetheless some analysts commented that would not be surprised to see a rate cut today. NZDUSD is under pressure as well not only by oil prices but from the on weaker than expected inflation data last night. There are talks that the weak inflation data could made RBNZ consider to cut interest rates as it’s moving away from the 1-3% inflation target. Analysts expected RBNZ OCR at 2.00% by middle of the year while currently is at 2.5%. AUD is also weighed down by rumours of RBA rate cut.

UK job data came in soft but did not surprise markets but FTSE is trading near the 5700 area. Yesterday we also had the dovish comments of BOE Governor Carney and the warnings of more damage due to China.

View our full economic calendar for a daily roundup of major economic events.

Data releases to monitor:

CHF: ZEW Economic Expectations

CAD: BOC Rate Statement, Overnight Rate, Manufacturing Sales m/m

USD: Building Permits, CPI m/mn, Core CPI m/m, Crude Oil Inventories

Trade Idea of the Day

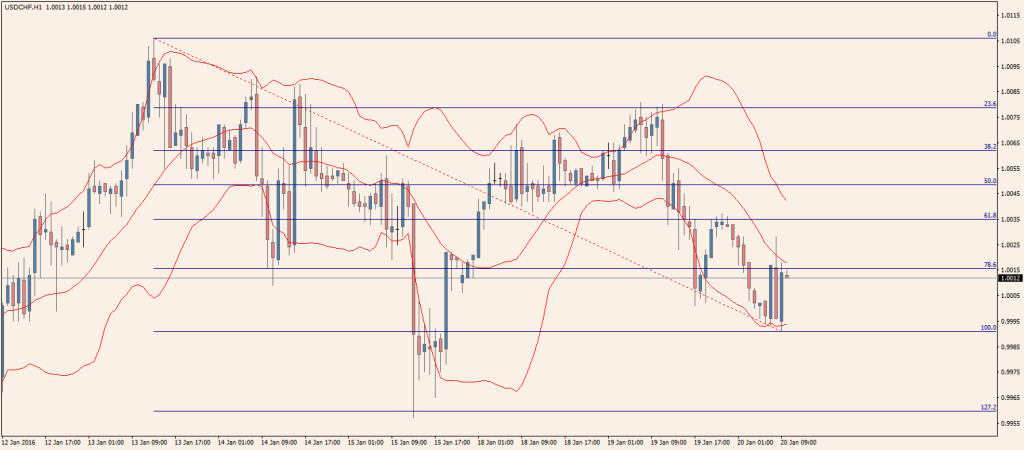

USD/CHF

Currently the pair is trading at 1.0012. Traders must monitor the 1.0080 resistance level and the support level 0.9960 for possible breakouts. A possible scenario would be a further downwards movement and break of 0.9990 with target the 0.9960 level. An alternative scenario would be a break of 1.0035 resistance with target the 1.0065 area.

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market Analysis forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf Vinson Financials Broker