[text]

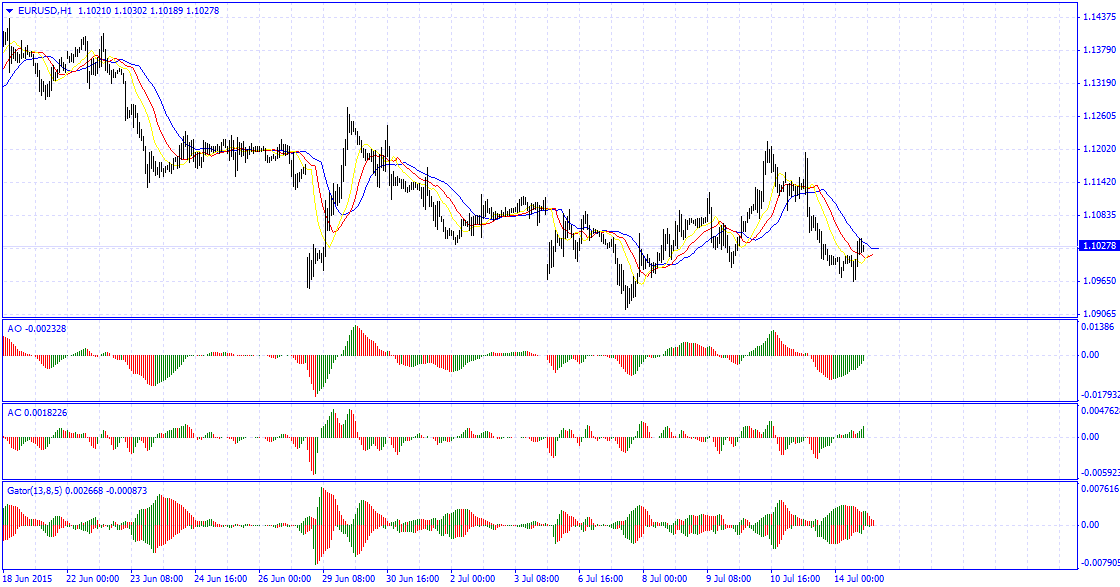

EUR/USD is slowly rolling over again, trading into 1.1010 after moving over 1.1030 ahead of the London close. U.S. yields are higher pushing the interest rate differential in favor of the greenback, but traders remain leery, as perhaps the realization that the Greek crisis still has potential to cause pain remains.

The EUR/USD generated a key reversal day again, as the as a new low and lower close were made and prices are poised to test trend line support near an upward sloping trend line that connects the lows in April to the low in July and comes in at 1.0950.

Resistance is seen near the 10-day moving average at 1.1070. Momentum remains negative with the MACD (moving average convergence divergence) index printing in negative territory with a downward sloping trajectory. The RSI moved lower with prices action reflecting accelerating negative momentum pointing to a lower exchange rate.

EUR/USD Chart

Source: Fxempire

[/text]

Categories :

Tags : eur EUROUSD Forex News