Today’s important Forex market news – Sterling was sagging in early European trade as we head into today’s MPC meeting. This is really about gauging subtle shifts in MPC thinking since August, when policy was eased and a decent indication was given that it may have to be eased again later this year. On the face of it, the data has not been shifting this way, so the potential for sterling volatility is largely going to come from any change in this perception as revealed in the minutes to the meeting. Initial cable resistance comes in at 1.3164.

Talking of central banks, the SNB today kept key policy rates unchanged at their quarterly meeting, with the target for Libor remaining at -0.25%. There was no reason for the Swiss franc to get excited and it was no surprise to see the SNB re-iterating that the franc remains significantly overvalued.

Elsewhere, the latest labour market data in Australia saw a small fall in the unemployment rate to 5.6%. The Aussie was little changed, with the dollar-bloc (CAD and NZD) generally softer as we head into the FOMC meeting next week.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

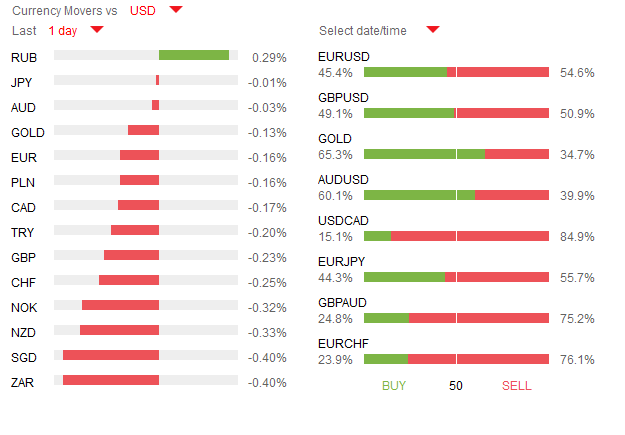

Currency Movers and Client Positions

Source: Fxpro Forex Broker

Review and Forex Rebates Up to 85%

Categories :

Tags : CAD and NZD FOMC meeting forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market News forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf MPC Philadelphia Fed Manufacturing Survey SNB Trade Balance n.s.a. Trade Balance s.a.