US employment data, PMIs, Eurozone CPI(2016.02.29)

Source: Fxprimus Forex Broker (Review and Forex Cashback up to 85%)

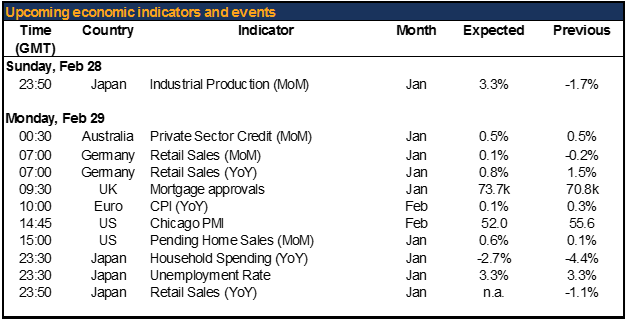

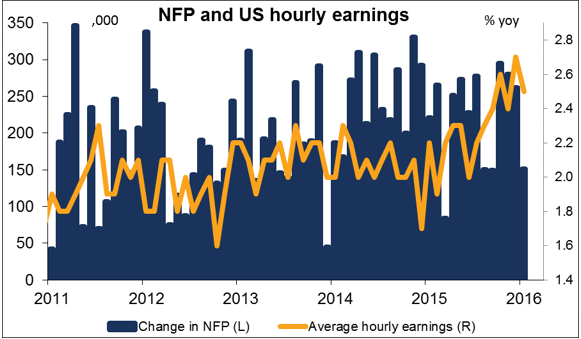

Nonfarm payrolls are expected to rise, the unemployment rate is expected to remain below 5%, and average weekly earnings are expected to accelerate – it should be supportive for the dollar. Fed funds rate expectations rose last week on improving prospects for a Fed rate hike and they could rise further this week.

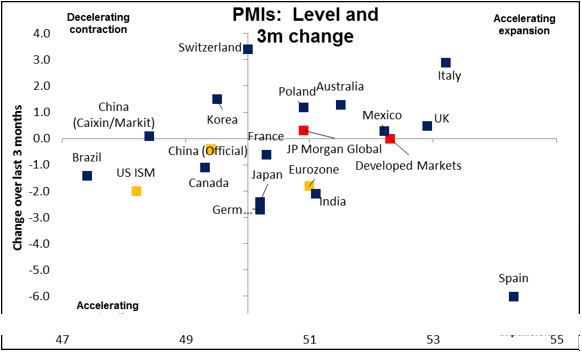

The other big indicator of the week will be the PMIs for February:the final Markit PMIs for those countries that earlier released preliminary ones (Germany, Eurozone, US) and all the others. Looking at the forecasts, only the US PMIs are expected to improve; all others are forecast to be either unchanged or lower, including the UK. The news could be negative for EUR/USD. China’s manufacturing PMIs are expected to be unchanged at below-50 levels, which I suppose is better than falling, but still shows weakness. AUD and the other commodity currencies could suffer as a result.

Categories :

Tags : Eurozone forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex News forex tutorials for beginners pdf Germany how to trade forex for beginners pdf learning forex trading pdf US