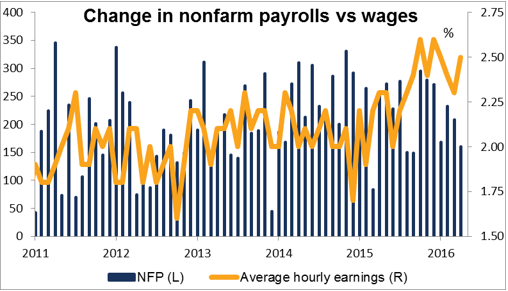

US Nonfarm Payrolls – It’s NFP day today – the market will naturally focus on today’s nonfarm payroll figure. After yesterday’s astonishing spot-on ADP report – the first time I can remember the market consensus forecasting that particular indicator absolutely correctly – the market will be looking for a payrolls figure spot-on the consensus of 160k and maybe even an average hourly earnings figure as expected at 2.5% too. Both those figures are exactly the same as in the previous month, suggesting that employment and wage growth have plateaued. As long as they stay around current levels, it seems to be consistent with the Fed gradually tightening and therefore a figure at or near the consensus should be USD-bullish.

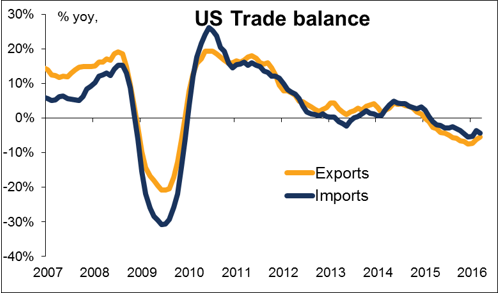

At the same time, the US trade balance for April will be announced. The trade deficit is expected to widen a bit, although the recent trend seems to be improving – the pace of decline in exports seems to be lessening. That figure can be market-affecting, but I’d expect its impact to be totally lost in the excitement over the NFP.

Later in the day, the ISM non-manufacturing index for May is expected to slip slightly, while US factory orders, which will be released at the same time, are expected to slow from the previous month. The joint effect of two negative indicators could weaken USD a bit, depending of course on how the NFP figure affected market sentiment

Source: Fxprimus Forex Broker (Review and Forex Rebates Up to 85%)

Categories :

Tags : forex bonus without deposit Forex Broker forex broker bonus forex learn forex learning forex learning pdf Forex Market Analysis forex tutorials for beginners pdf how to trade forex for beginners pdf learning forex trading pdf NFP day US nonfarm payrolls USD-bullish