Source: XM Broker (Review and FX Rebates up to 85%)

The loonie fell to fresh 12-year lows versus the greenback, as weakness in the oil price (oil is a major export for Canada) combined with bullish sentiment on the US dollar led the USDCAD pair substantially higher. The loonie is now the worst performing G10 currency of the year versus the US dollar with year-to-date losses in excess of 18%.

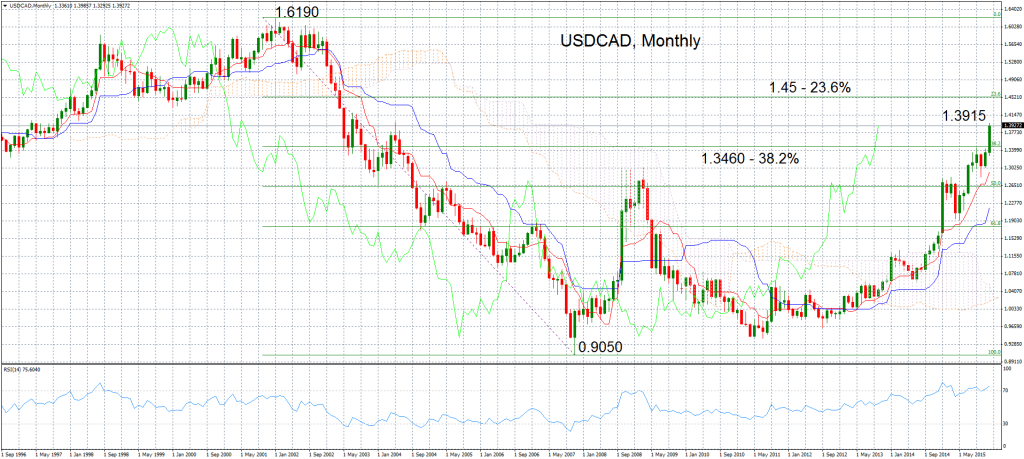

The latest move has been relatively sudden and sharp and this is reflected in the relative strength index (RSI), which at 81 on the daily chart suggests strongly overbought conditions. This in turn suggests that there could be a temporary correction for the pair before it heads higher.

Otherwise, the chart is strongly bullish as the trend is pointing upwards for the past 4 years. There are two levels close by that are important from the Fibonacci retracement points of the downmove from 1.6190 in January of 2002 to the November 2007 low of 0.9057. The 38.2% level is at 1.3460 and it could act as support if there is any correction. The 23.6% retracement is at 1.4560, which could be the target when the uptrend resumes.

USD/CAD Chart

Categories :

Tags : Forex Market Analysis USD/CAD